What are Fixed-Income Securities

Apr 05, 2023 By Triston Martin

Do you ever think that certain financial terms can be confusing? Many people need to be aware of fixed-income securities, how they function, and their importance. Investments known as fixed-income securities give a return in regular payments and a principal return at maturity.

While they may seem intimidating to those, who need to become more familiar with financial markets, understanding this concept is essential for anyone looking to build their portfolio wisely and grow their money over time. This blog post will explore fixed-income securities and why investors use them.

What are fixed-income securities?

Fixed-income securities are investments that provide a return in the form of periodic payments and the eventual return of principal at maturity. They can be issued by governments, corporations, or other organizations as an alternative to stocks and bonds. Fixed-income investments help investors diversify their portfolios while providing steady, predictable income.

Fixed-income securities can be classified into two main categories: debt and equity. Debt securities include bonds, notes, and treasury bills. Equity securities are also known as preferred shares or perpetual. Common characteristics of fixed-income investments include a predetermined coupon rate, maturity date, and issue price.

Fixed-income investments offer many advantages to investors looking for a safe and reliable source of income. They are often protected against inflation, providing investors consistent returns over long periods. Additionally, fixed-income investments generally have lower default rates than stocks or bonds.

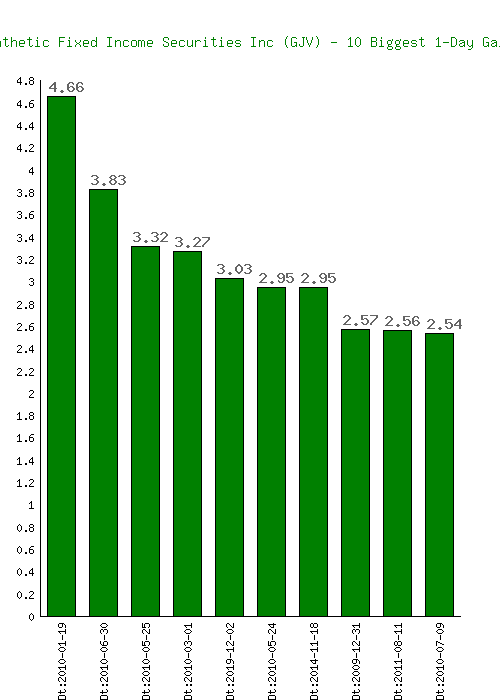

Synthetic fixed income securities inc

Old derivatives such as swaps, options, and futures. Derivatives are financial instruments that derive value from the underlying financial asset being traded. They provide investors an alternative way to gain exposure to fixed-income securities without owning them.

For example, an investor can enter into a swap transaction with another party where they agree to exchange the principal and interest payments of two different fixed-income securities. This allows investors to gain exposure to fixed-income securities without having to buy them outright.

Fixed-income securities are important for diversifying portfolio risk and mitigating losses during economic downturns or market volatility; due to their relatively low correlation with other asset classes, fixed-income securities hedge against losses generated by equities or commodities. This allows investors to maximize their returns while minimizing the volatility in their portfolios.

Example of fixed-income securities

Fixed-income securities offer a return in recurrent payments and a principal return at maturity. Bonds and preferred stock are fixed-income securities corporations, governments, and other institutions issue. Because the US government is backing Treasury bills and notes with full faith and credit, they are also regarded as fixed-income securities.

Investing in fixed-income securities means lending money to a company or government at a predetermined interest rate. The periodic payments come from the coupons attached to the security, representing the interest earned on your investment. At maturity, you will receive your principal and any remaining coupon payments.

Why are bonds called fixed-income securities

Fixed-income securities, or bonds, provide investors with a steady and reliable income stream in exchange for the money they have loaned to an entity (such as a government or corporation). Bonds typically have fixed terms such as maturity dates and coupon rates. The coupon rate is the rate at which interest is paid on the bond, typically semi-annually. Most bonds have a fixed face value (par value) that is returned to the investor at maturity.

Fixed-income securities are attractive to investors because they provide steady returns with minimal risk and liquidity, making them an ideal investment for those looking for safety and stability in their portfolios. They can also be used to help diversify a portfolio and balance out any riskier investments.

In addition, bonds can provide tax advantages because most of the return comes from interest payments, which are often tax-exempt depending on the issuing entity. Additionally, bonds can buffer market volatility as they may not decrease in value as much as stocks do during bear markets.

Fixed-income securities can be a great way to create a secure and stable income stream for retirement or other long-term goals. With the right knowledge and research, they can help you reach your financial goals while minimizing risk. It’s important to remember that all investments carry some level of risk, so it’s important to consider your situation and risk tolerance before investing.

What are the characteristics of fixed-income securities

Fixed-income securities are debt instruments that derive their value from the contractual obligation of an issuer to pay a fixed or variable interest rate periodically and repay the principal at maturity. Fixed-income securities have several key characteristics:

- Maturity: All fixed-income securities have a specified maturity date on which the principal and interest payments must be repaid.

- Coupon: Fixed-income securities have a specified coupon rate, which is the annual rate of interest paid to the investor over the life of the security. Coupon rates can be fixed or floating, adjusting according to market conditions.

- Risks: Fixed-income securities are subject to various risks, including credit and interest rate risks. Credit risk is the possibility that the issuer cannot make timely payments or repay the principal at maturity. In contrast, interest rate risk is associated with changes in the market rate of return on the security.

- Redemption: Some fixed-income securities have call provisions that allow the issuer to redeem on or before a set date, while other fixed-income securities are non-callable and must remain outstanding until maturity.

- Taxes: The investor must pay taxes on the income received from fixed-income securities by their personal tax situation.

Fixed-income securities are an important component of many investment portfolios, and understanding how they work is essential for any investor looking to build a well-diversified portfolio. Knowing the key characteristics of these securities and the associated risks is essential for any investor looking to make informed investment decisions.

FAQs

Are stocks fixed income?

No, stocks are not fixed-income investments. Stocks have the potential to generate a return on investment over time, but they are considered to be equity investments because they do not guarantee a set return. Fixed-income securities, however, provide a predictable return and principal repayment at maturity.

Are dividends fixed-income?

No, dividends are not considered fixed-income instruments. Dividends represent a portion of a company's profits paid out to shareholders regularly and are generally considered equity income rather than fixed income. The return from stocks depends on the underlying shares' performance, while fixed-income securities offer predetermined payments with no market risk.

Why is fixed income risky?

Fixed-income investments can involve risk depending on the creditworthiness of the issuer and the overall market conditions. In addition, fixed-income securities may be subject to interest rate or inflation risks, which can cause their value to fluctuate over time.

Conclusion

In conclusion, fixed-income securities are vital investments for those seeking a steady stream of income and long-term portfolio diversification. Although they come with risks and challenges, investors can mitigate these by carefully researching and understanding the various types of Fixed-Income options available to them.

The decision to invest in Fixed-Income Securities should always be an informed one; investors should carefully weigh the potential opportunities and challenges before making any decisions. Ultimately, Fixed-Income investments provide financial security and stability by establishing a reliable source of income during retirement or other periods of need.